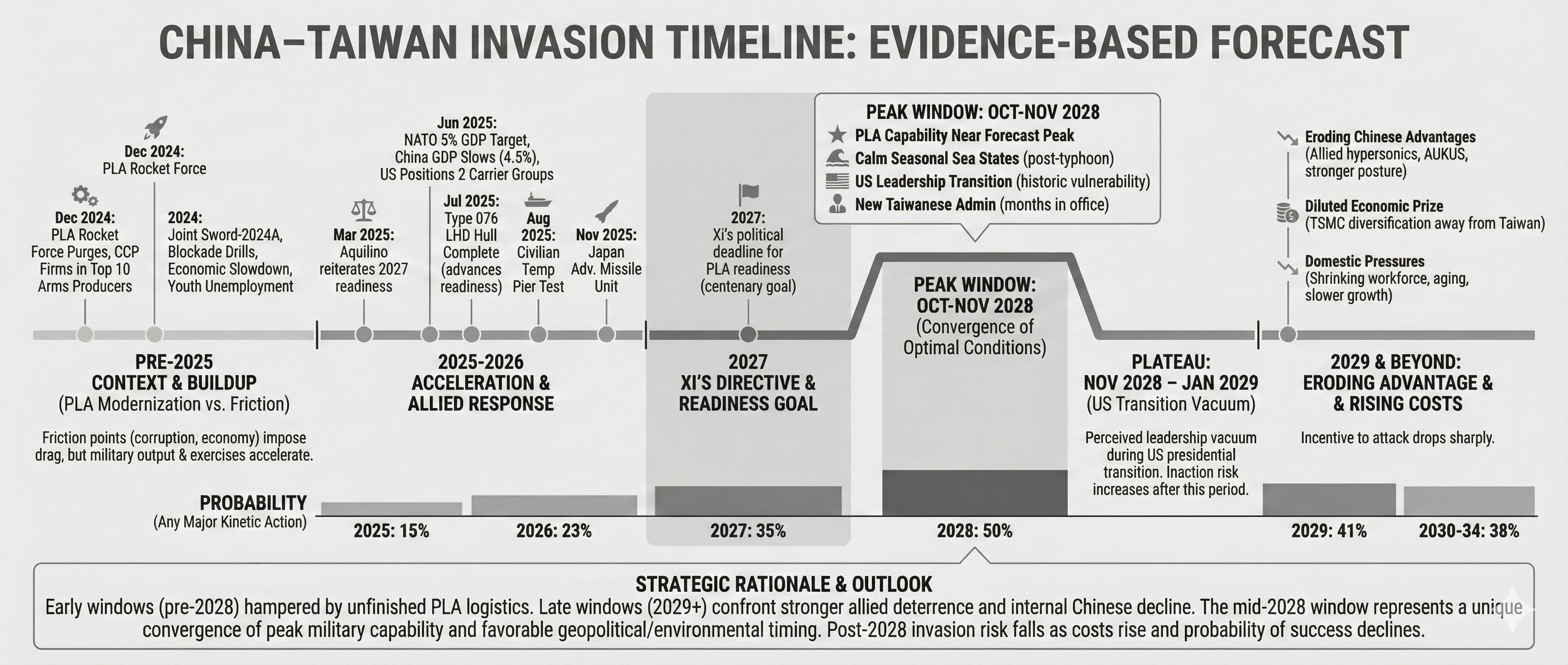

Beijing's best opportunity to apply large-scale military force against Taiwan falls in mid-October through late-November 2028. During that six-to-eight-week span the PLA's capability curve is still near its forecast peak, seasonal sea states are usually calm enough for amphibious operations yet typhoon probability has already collapsed, the US is inside a leadership transition that history shows adversaries probe, and the second consecutive pro-sovereignty Taiwanese administration will have taken office only months earlier.

Gemini timeline visualization

Gemini timeline visualization

The window plateaus between November 2028 to January 2029 during a perceived leadership vacuum during the US presidential transition period. Inaction after this period continues to decline in probability due to allied strength, economic pressures, and Taiwanese national identity minimizing the prospect of peaceful reunification.

Rapid growth in China's shipbuilding, landing docks (LHD), large military transport aircraft, missile output, and arms-industry revenues, plus NATO's recent pledge to raise defense spending to 5 percent of GDP to counter Chinese capacity, compress the timeline.

Concurrently, corruption purges inside the People's Liberation Army (PLA), economic headwinds and expanding US–allied deployments impose significant drag.

If Beijing can solve lift, logistics, and counter-intervention gaps while maintaining domestic stability, probability approaches parity — if deterrence remains credible and China's economy slows further, invasion risk falls toward zero. 1 2 3 4

Strategic Rationale for CCP

Earlier windows (Spring 27 - Spring 28) suffer from unfinished PLA lift/logistics expansion and higher US alert. Later windows (2029+) confront eroding Chinese advantages and stronger allied postures.

Party leadership views unification as essential for regime legitimacy, control of advanced semiconductors, and breakout access to Pacific sea-lanes. Xi's directive for PLA readiness by 2027 sets a political deadline linked to the centenary and his power ambitions.

Growing US–Japan–Philippines coordination and NATO's funding surge reinforce Beijing's fear of a tightening strategic ring, incentivising earlier coercion or force to prevent Taiwan's further military integration with the West. 5 6 7 8

Evidence supporting timeline shift

China's arms industry output, shipbuilding pace, and military exercises have all accelerated since 2023, while Western alliances have responded with record defense spending and deployments. Simultaneously, PLA corruption purges and economic headwinds have introduced new friction, shaping the invasion window.

2029 and Beyond

Beijing's incentive to attack Taiwan drops sharply after 2028 when advantages fade while costs rise. The PLA's edge narrows as the US and its partners field hypersonic weapons, tighten joint exercises, and deploy AUKUS submarines and new bombers, eroding China's present kinetic timing advantage. 351213

At the same time, TSMC's advanced plants in Arizona, Germany, and Japan dilute global reliance on Taiwanese fabs, shrinking the economic prize.6

Domestically, a shrinking workforce, rapid aging, and slower growth sap the resources and political room needed for a drawn-out, sanction-laden conflict and occupation. Taken together, these shifts make a post-2028 invasion far less likely than one attempted in the mid-2020s. 6151420

Probability matrix

Note: Probabilities are independent by campaign type. Column totals reflect the chance that at least one of the three manifests in that calendar year. Percentages are rounded. Residual probability lies in grey-zone pressure short of overt force.

Adjustment factors

Note: Add or subtract the relevant modifiers to the baseline column total for a scenario‑specific outlook. Example: if by mid‑2027 the PLA has validated its assault logistics and AUKUS forward‑deploys missiles to northern Australia, the net 2027 probability becomes 38%.

Domestic pressure gauges

Probabilities are independent

Note: Readings above the 2014 stress baselines correlate with higher leadership risk-taking propensity, 2025 and beyond are forecast figures.

If local government financing vehicle (LGFV) bond roll-over exceeds ¥4 trillion, it competes directly for credit, raising the cost of sustaining a blockade or prolonged occupation. This financial strain increases leadership fears of a crisis, pushing them toward decisive action before debt risks spiral, and may accelerate invasion timing to 2027-28 in hopes of a quick, high-reward outcome.

If land-sale revenue drops below ¥4 trillion, local governments have less funding for mobilization logistics and civil-military transport upgrades. This shortfall heightens unemployment and protest risks during conflict, increasing the regime's need for diversionary nationalism. While fiscal pressures might argue for delay, rising social unrest could also motivate leaders to act sooner.

Operational readiness indicators

November 2025 training exercise

November 2025 training exercise

Reuters imagery of the August 23, 2025 drill near Jiesheng shows six ferries and six deck cargo ships offloading roughly 330 vehicles directly to the beach via a floating pier assembled and torn down in about 3.5 hours.10

The exercise demonstrates that the civil fleet is now integrated into first-wave logistics and is rehearsing distributed small landing points that complicate Taiwan's defense planning.10

Sea-state and tide constraints

Historical average (2000-2022) days per month meeting amphibious launch criteria (Sea State ≤ 3 and tidal height ≥ 1 m).

Note: Q3 typhoons reduce viable launch days by ~50 % versus spring averages; the January northeast monsoon produces under-10-day windows, compressing feasible assault start dates during 2026-28.

Amphibious force-flow & sustainment tonnage

Note: The Joint Logistics Support Force depots at Zhangzhou (8000 t capacity) and Quanzhou (4500 t) can stage roughly 12500 t, leaving a 2500 t/day shortfall versus the 15000 t/day minimum that RAND modeling identifies for sustaining a mechanized corps ashore.

CCP campaign design

The integrated campaign is designed to overload allied decision channels: simultaneous kinetic strikes against Taiwan, theater-wide harassment to sap US/Japanese timing, and global economic jolts to sway political capitals toward restraint. 2728

Public ASBM (anti-ship ballistic-missile) demonstrations are only one layer — beneath that headline threat sits a cross-domain pressure architecture intended to keep the US guessing which fire to put out first.

Initial phase would apply a joint blockade covering Taiwan's key ports, airfields and subsea data cables, executed by East Theater Command surface groups, maritime militia, and coast-guard elements, while Rocket Force suppresses fixed-wing sorties and air-defense sites with precision missiles. Simultaneously, cyber and political-warfare units would seek to paralyze Taipei's command network and sow panic.

CCP leadership may pursue additional tactics to create leverage:

-

Financial disruption via dumping part of its US Treasury holdings during the first week of combat to spike US borrowing costs and test resolve.

-

Rare-earth embargo with immediate halt on neodymium, dysprosium, and gallium exports, aiming to slow allied missile and drone production cycles.

-

Undersea cable cuts with pre-positioned uncrewed submersibles sever key trans-Pacific fiber lines, forcing data reroute via slower satellite links, degrading allied command latency.

-

Grey-zone cyber on civilian infrastructure with ransomware attacks on Japanese railway signaling and Australian power distributors to generate domestic political distraction.

-

Proxy escalation in Middle East by delivering emergency oil product shipments to Iran or encourage Houthi raids on Red Sea lanes, driving up tanker insurance prices and dividing US naval assets.

If Taipei concedes, occupation forces land at Tamsui and Taichung to secure government and chip plants. If resistance persists, follow-on amphibious echelons from three Type 075s and the first Type 076 would aim for lodgments on the southwest littoral, supported by airborne assaults on Chiayi and Pingtung to split the island.

Throughout, long-range anti-ship fires and unmanned swarms focus on delaying or deterring US–allied intervention assets transiting the Bashi and Miyako Straits, reflecting published PLA concepts for "counter-intervention." 29 30 31

Monitoring First Moves

Analysis of PLA exercise patterns, commercial-satellite imagery, and logistics studies indicates two clocks: a 20-30-day strategic mobilization followed by a hard-to-reverse 72-hour tactical launch.

During the longer phase Beijing would assemble three Type-075 LHDs, eight Type-071 LPDs, the first Type-076, roughly fifteen requisitioned Ro-Ro ferries, missile craft, mine-layers, and a forty-ship logistics train — historical imagery (Joint Sword-24A and the August-23 Fujian drill) shows the big-deck moves from Sanya, Zhanjiang, Yulin and Zhoushan to Fujian load ports take 7-10 days.

About 150 000 t of fuel, munitions and bridging equipment would travel by night rail and civil trucks to Zhangzhou and Quanzhou over 10-14 days. Sealed orders would reach Rocket Force brigades while redundant C4I nodes and Gaofen/Yaogan ISR constellations surge for 5-7 days, and maritime-militia and coast-guard craft would declare "fishing exclusion zones" up to a week before H-hour.

These steps generate conspicuous signatures — AIS gaps, port-traffic spikes, rail-head convoys and civil-aviation NOTAMs — letting Western sensors provide roughly two to three weeks of warning that planning has tipped into execution.

Once lift is loaded and the Strait forecast offers sea-state ≤ 3 and tide ≥ 1 m, the PLA shifts to the short clock: 72 hours before H-hour Rocket Force TELs disperse and theater air assets hide on highways with ECM sites active. 36 hours out assault echelons depart Xiamen, Pingtan, Sandu and Wenzhou at night along with civilian-flagged ferries. 12 hours out ASAT and cyber preparatory fires begin and mainland air-defense rises to Combat Readiness-1. At H-hour a 1400-missile barrage, GPS-jamming and UAV screens shield convoys that cross the median line in 6-8 hours and land forces within 12 hours.

During the strategic phase carriers can redeploy from Guam toward Philippine waters in four to five days, CONUS or Guam bombers load within 48 hours, and Japan-based F-35s and Patriot batteries disperse in under 24 hours; after TELs leave shelters Washington has only about 48-72 hours to decide on pre-emptive cyber, mining or blockade moves, and post H-hour only submarines, pre-positioned long-range missiles and fighters already inside the First Island Chain can affect the opening day.

Analysts should expect two to three weeks of unmistakable logistics activity, then two to three days from fleet sortie to the first missile wave and less than 12 hours before beachheads, so the US must forward-station ISR assets and magazines and rehearse a 48-hour surge because waiting for imagery of ships entering the Strait leaves hours, not days, to act.

Deception Potential in PLA "Ship-Kill" Drills

Chinese ASBM tests that replay strikes on carrier-sized targets in the desert or scripted "sink the hulk" exercises in the Yellow Sea are broadcast in high resolution for foreign audiences.

Part of the intent is plainly demonstrative: remind Washington that surface groups face high risk inside the First Island Chain. Chinese doctrinal writings on informationized warfare also discuss the value of shaping an enemy's scheme of maneuver by letting him "observe what he expects to see."

This involves actions, including:

- Publishing telemetry of DF-21D/DF-26 launches while withholding data on quieter, harder-tracked threats (sub-kiloton sea-bed mines, YJ-21B air-launched hypersonics, stealthy autonomous torpedoes)

- Staging highly visible ASBM salvos in peacetime to channel US planners toward large-deck carrier avoidance, only to switch to air-delivered hypersonics against logistics shipping once war begins

- Training maritime militia "fishing fleets" in mob-boarding drills, so US focus stays on kinetic missiles instead of mass civil swarming that can clog strait lanes

The very public ship-kill tests are not the attack plan in isolation — they are one narrative tile in a deception mosaic meant to anchor US expectations on the most obvious threat axis while other, softer counters mature off-camera.

Discussion

A kinetic move against Taiwan would be the first forcible annexation of a technologically advanced democracy by a nuclear‑armed power since 1945. That step breaks the post‑Cold War presumption that great‑power frontiers are stable, discrediting every assurance Beijing has given its neighbors about peaceful rise and non‑use of force.

Once deterrence fails in the Taiwan Strait, Tokyo, Seoul, Manila, Canberra and potentially Berlin rewrite their defense legislation and budgets on the assumption that major‑power war is no longer a low‑probability event. Even a short campaign that ends in stalemate erases thirty years of confidence‑building norms and no plausible diplomatic formula can rebuild them in less than a generation.

Once the People's Liberation Army crosses the median line with live rounds, the pre‑2025 international system is finished. Trade flows, capital allocation, alliance structures and military postures will lock into a new configuration that assumes enduring contest with Beijing. History shows that such tectonic moves, once triggered, unwind only after regime‑level change and decades of verification.

In every realistic branch of the decision tree, an invasion is a one‑way door.

Footnotes

-

China's massive next-generation amphibious assault ship takes shape ↩

-

Corruption may have disrupted Chinese military modernization goals ↩

-

Expect Taiwan tensions to rise ahead of Trump inauguration ↩

-

NATO chief Rutte floats two-tier spending plan to meet Trump target ↩

-

China criticizes Japan's plan to deploy missiles on island near Taiwan ↩

-

Nearly one in 10 Tier-1 subcontractors to defense primes are Chinese firms ↩

-

NATO countries approve Hague summit statement with 5% defense spending goal ↩ ↩2

-

China can maintain high growth, transition to consumer-led economy - Premier Li ↩ ↩2

-

Top 100 arms-producing and military services companies, 2023 ↩ ↩2

-

Corruption may have disrupted Chinese military modernization goals ↩

-

China's massive next-generation amphibious assault ship takes shape ↩

-

Military and Security Developments Involving the People's Republic of China ↩

-

Military and Security Developments Involving the People's Republic of China ↩ ↩2

-

Corruption may have disrupted Chinese military modernization goals ↩

-

Military and Security Developments Involving the People's Republic of China ↩

-

Senior Defense Official briefs on China Military Power Report ↩

-

Corruption may have disrupted Chinese military modernization goals ↩

-

China can maintain high growth, transition to consumer-led economy - Premier Li ↩

-

How China could quarantine Taiwan: mapping out two possible scenarios ↩

-

First battle of the next war: wargaming a Chinese invasion of Taiwan ↩