Jeffrey Epstein's wealth accumulation, as reconstructed from primary documents and investigative reports, reveals a pattern of opportunistic career moves, high-risk financial plays, and leveraging elite connections. 12345678910

In the 1970s, he transitioned from teaching to Wall Street trading, building modest savings through salary and early bonuses.12

The 1980s marked his launch into independent ventures, using asset recovery and consulting gigs — including the Towers Financial affair — to generate seven-figure income while avoiding direct liability in schemes.34

By the 1990s, money management for billionaires like Leslie Wexner scaled his personal holdings through fees and investments, with property acquisitions and offshore structures further boosting his net worth.567

The 2000s focused on diversified entities, real estate, and opaque banking arrangements, culminating in a documented nine-figure empire by his death, and potentially ten-figure through hidden trusts and shell companies.8910

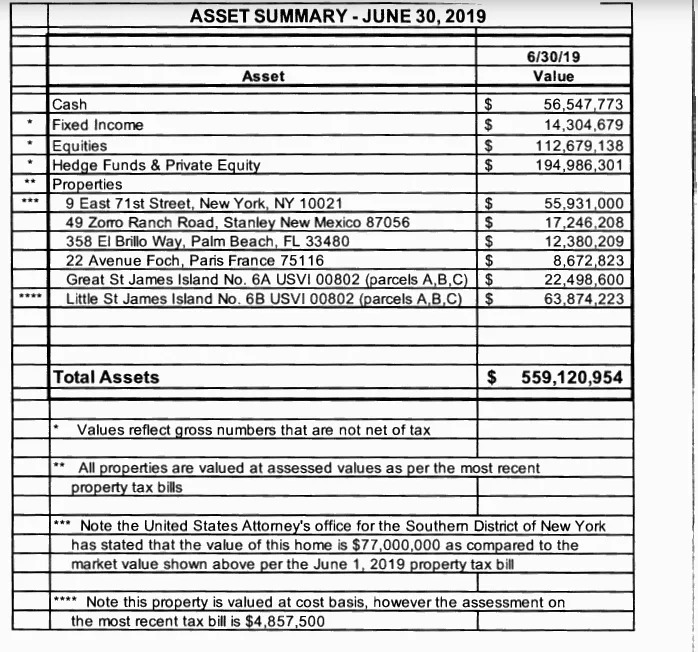

He used offshore entities in the U.S. Virgin Islands, Bermuda, and Delaware to obscure income and minimize taxes. By the time of his death in 2019, his estate was valued at at least $577 million, though the true figure may be higher due to a lack of audited records.1112

1970s Wealth Sources

In the 1970s, Epstein established the foundation of his wealth by transitioning from teaching to Wall Street trading, leveraging early career opportunities at Bear Stearns that offered commission- and bonus-structured total compensation packages.

These early ventures provided him with essential experience and contacts, serving as a springboard into lucrative financial circles.

1980s Wealth Sources

Epstein's wealth multiplied significantly throughout the 1980s as he pursued independent ventures and strategic consulting roles. He capitalized on the emerging asset-recovery industry, securing high contingency fees, and leveraged consulting engagements such as Towers Financial to secure consistent cash flow. Establishing his own wealth management firm, J. Epstein & Co., solidified his position and enhanced his visibility within affluent circles.

1990s Wealth Sources

During the 1990s, Epstein significantly expanded his wealth through exclusive management of assets, notably those of billionaire Leslie Wexner. His financial acumen and advantageous legal arrangements, including offshore entities, substantially reduced his tax burden.

Strategic acquisitions, such as prominent real estate purchases in Palm Beach and the U.S. Virgin Islands, further enhanced his financial stature and facilitated wealth preservation.

2000s Wealth Sources

In the 2000s, Epstein's wealth expanded into the hundreds of millions through complex financial vehicles and opaque business arrangements. JPMorgan Chase audits show that Epstein's baseline lifestyle cost was 1 million in cash withdrawals each year.

He engaged in profitable repurchase agreements via Liquid Funding, accumulated substantial assets through Southern Trust, and diversified his holdings through extensive real estate purchases. His philanthropic entities, such as Gratitude America, served as conduits for financial flows, enhancing his influence within elite networks.

In the case, Financial Trust Company, Inc. and Jeffrey E. Epstein v. Citibank, N.A. and Citigroup, Inc. (case No. CIV-2002-108, U.S. District Court for the District of the Virgin Islands), Epstein filed a declaration outlining his business (Financial Trust Company). In the declaration supporting his amended complaint, Epstein detailed his business operations, stating that J. Epstein & Company/Financial Trust Company had roughly 20 employees, approximately $100 million under management, and about $88 million in shareholder capital. This declaration minimizes the company's capital compared to released balance sheets for FTC.

Principal Wealth Vehicles by Decade

Intelligence Gaps

There are several issues leading to best estimates:

- No audited statements for J. Epstein & Co. (1988-2007) or FTC (1997-2019)

- Full client roster beyond Wexner, Khashoggi, and an identified Rockefeller family trust remains unconfirmed

- Liquid Funding counterparty list after Bear Stearns' 2008 collapse is under seal in SDNY bankruptcy exhibits

Estate Valuation Snapshot (2019)

Probate filing: St. Thomas Superior Court, docket ST-2019-PB-272.11

References

Footnotes

-

See Riddell, "Epstein at Dalton and Bear Stearns". ↩ ↩2 ↩3 ↩4

-

Primary Source Docs: Bear Stearns employment, 1970s. ↩ ↩2 ↩3 ↩4 ↩5 ↩6

-

Riddell, "Towers Financial and J. Epstein & Co.". ↩ ↩2 ↩3 ↩4 ↩5

-

Primary Source Docs: Wexner power-of-attorney, 1991. ↩ ↩2 ↩3 ↩4 ↩5

-

Property Raids: Palm Beach, USVI, and NM holdings. ↩ ↩2 ↩3 ↩4 ↩5 ↩6

-

Post-Deutsche Bank: Liquid Funding and banking gaps. ↩ ↩2 ↩3 ↩4

-

Primary Source Docs: Southern Trust and 2017 filings. ↩ ↩2 ↩3 ↩4

-

Primary Source Docs: Foundations, philanthropy, and 2019 estate filings. ↩ ↩2 ↩3 ↩4

-

In re: Estate of Jeffrey E. Epstein, St. Thomas Superior Court probate inventory (Aug 2019). ↩ ↩2

-

Bloomberg, "Epstein Signed Will Two Days Before Death" (Aug 19 2019). ↩