Jeffrey Epstein. A myth. A criminal. A juggernaut. A liar. An enigma.

The unfortunate truth is that the deeper you go into Epstein, the less it looks like a grand conspiracy but instead a corruption of the American Dream. Epstein was highly intelligent and driven, but from the 1970s to 1980s his path in life took a darker turn through international, intelligence-adjacent networks and NYC greed.

From all analysis of available financial documents, Epstein made his wealth like a traditional VC/PE investor — he garnered 2&20 fees (2% annual management fee plus 20% of profits) from his relationship with Les Wexner and used that revenue to buy assets, both real estate and distressed companies. He made his first millions by 1981, and from 1985 to 1999 he amassed nearly $200 million and averaged $40-50 million in management fees in most years.

Epstein chaired Liquid Funding — a partnership with Bear Stearns — a debt-funding operation based in Bermuda, from 2000 to March 2007. Liquid Funding used real estate assets as its primary debt mechanism, relying on the AAA ratings of those assets (see The Big Short). He left a year before Bear Stearns' implosion during the 2008 CDS fiasco, as he was actively negotiating his 2008 plea deal. This work added $20–40 million in revenue for Epstein.

After his 2008 sentence, Epstein made the bulk of his new money through his work for Leon Black and his family office. While the nature of his activities is debated and rumors swirl, an internal audit shows that Epstein performed three types of tasks for Black from 2013 to 2017: 1) family office operations, 2) structuring the Black family trust to minimize inheritance tax, and 3) handling miscellaneous problems of the ultra-wealthy (art, boats, jets, etc.). Over those years, Leon transferred $158 million to Epstein, lent him money for an art deal, and eventually ended up in arbitration over the final invoice Epstein expected to be paid.

Epstein cultivated a mythos around exclusivity that evolved over time. In a July 1980 Cosmopolitan "bachelor of the month" profile, he was described as a "dynamo" who "talks only to people who make over a million a year!" By the late 1980s, he had inflated this tagline, bragging that he worked exclusively with billionaires due to the high fee potential — a minimum of $20M per year, per client.

Epstein spent roughly 10% of his best years' revenue on questionable things — payments to Eastern European women, legal fees, and trafficking-related expenses, while also averaging $1M in cash withdrawals a year. Maintenance of his lifestyle was another 20% — airplane and island maintenance, staff, and $25M to Ghislaine for managing his properties and other activities.

Epstein's investments are mostly opaque, but all assets were invested through other broker-dealers (JPMorgan, Fidelity, et al.), with no SEC/FINRA-registered entities owned by Epstein. After leaving JPMorgan Chase, Epstein moved his primary banking relationship to Deutsche Bank, where the bank flagged and monitored his transactions, but took no action beyond asking the nature of transfers to Russian women. Epstein's personal lawyer is on record asking how to withdraw cash without triggering AML reporting. For an op or intelligence agent, Epstein and associates were both lazy and inept at financial crime.

A key but unreported detail of the final weeks of his life: Jennifer Araoz served Jeffrey Epstein with a civil lawsuit under New York's new Child Victims Act on July 22, 2019, prompting his first reported suicide attempt the very next day. Then the establishment of the 1953 Trust and creation of a new will assigning the all assets to the Trust in the weeks after. The Child Victims Act opened Epstein up to prosecution of past actions without the previous statute of limitations that shielded his late 90s, early 00s activities. Time was up, and he knew it.

Epstein was a serial liar. This makes it difficult to sort fact from fiction. He creatively positioned why he left Bear Stearns. He inflated his client list. He inflated his employee count. He inflated his wealth. He took credit for others' ideas. He claimed support for the Me Too movement. Or did he? Did he broker the deal between the Saudis and Tesla? Did he run lucrative FX trading? Was he a CIA-Mossad asset? For now, not likely, unless you are writing Epstein fan fiction.

The following is a dossier assembled on Epstein in the wake of the Trump administration's supreme bungling of the release of case files and miscalculating the public's interest — and specifically the Conversative base's — in answers and justice. It's the culmination of night and weekend research in July 2025.

You can download 3,000 pages of public records detailing Epstein's finances, companies, and the Epstein Network. These documents include annual trust financial statements, estate asset lists after his death, civil lawsuits, findings from two major financial institutions, quarterly trust audits, and more.

Jeffrey Edward Epstein was a New York-based financier whose real-estate portfolio, network of charitable foundations, and social calendar attracted world leaders, scientists, and celebrities.

He taught math at Manhattan's Dalton School before vaulting onto Bear Stearns' special-products desk, founding a secretive asset-recovery shop, engineering cash flow for Steven Hoffenberg's Ponzi empire, and securing sweeping power of attorney over retail tycoon Leslie Wexner's fortune.

His network of shell corporations in the U.S. Virgin Islands, Bermuda, and Delaware obscured fee streams and lowered tax exposure by as much as ninety percent.

After his 2008 conviction for procuring an underage girl for prostitution, Epstein attempted to rehabilitate his image through donations and ostentatious events, using philanthropy to re-enter elite circles.

A probate filing one month after his 2019 jail suicide valued the estate at $577 million — a floor, not a ceiling, given the lack of audited statements.12

Financial expertise

Epstein's record reveals an uncommon combination of financial-engineering expertise, thorough working knowledge of domestic and cross-border tax law, and hands-on experience with the complex balance sheets of billionaire families.

Here is Epstein's consolidated balance sheet covering two financial trusts often discussed as his hedge fund — Financial Trust Company and Southern Trust Company — and his personal JPMorgan Chase account. Epstein separately operated over 28 additional entities and accounts tied to his properties and other ventures.

He quickly grasped complex legal, accounting, and regulatory concepts, translating them into clear, effective estate and business structures, and proactively identifying audit risks.

This skillset suggests a background in quantitative finance or private-client tax, refined through extensive experience advising individuals whose wealth matches that of major corporations.3

His success equally depended on his negotiation skills and emotional intelligence. Epstein managed teams of top-tier lawyers, accountants, and brokers, thoroughly questioning their assumptions while maintaining strategic oversight himself.

He turned intangible intellectual guidance into concrete, billable offerings, converting innovative ideas into deals or loan structures worth tens or hundreds of millions.

His broad network in academia, finance, and philanthropy consistently provided him with valuable insights, influential contacts, and unique deal opportunities, further strengthening his attractiveness to clients.3

Practically, Epstein acted as the main organizer of family-office operations: reviewing financial records, setting controls, hiring and firing personnel, and establishing reporting processes meeting institutional standards.

Whenever specialized issues arose — such as art transactions, luxury-asset regulations, or charitable structures — he quickly mastered the relevant guidelines, capitalized on opportunities, and moved forward.

Witnesses therefore describe him as adaptable and skilled, able to quickly understand high-value areas, master their rules, and turn this understanding into clear financial benefits for the families who employed him.3

Pre-2005 Legal Cases

Epstein appears in six publicly-available federal court matters before 2005. Three generated written opinions and a fourth is reflected only in the docket. None involve prostitution or trafficking that will surface later in state and federal filings after 2005.

In the December 2025 release of Epstein files by the DOJ, an FBI complaint documents a harassment and CSAM complaint from 1996, although the Bureau did not follow up beyond this. While the witness maintains the story, there is no evidence that corroborates the complaint.

All cases above are sourced directly from primary court documents or dockets. No other federal, territorial, or state litigation involving Jeffrey E. Epstein appears in public records before 2005, based on comprehensive searches of federal and territorial reporters, CourtListener, Virgin Islands opinions, and New York and Florida state-court databases.

Post-2005 Legal Cases

Real Estate Holdings

Epstein owned or controlled several high-end residences across the United States and Europe, which served as venues for social gatherings, scientific conferences, and, according to legal filings, abuse.

*Note: NYC Townhouse acquired formally in 1998, with Epstein living there in 1996, and potentially earlier in 1995.

Beyond his main residences, Epstein owned other major assets, including an airplane hangar and private firehouse at Zorro Ranch, highlighting the property's scale. He also operated a private jet — nicknamed the "Lolita Express" — used for long-distance travel. Flight logs later revealed many high-profile guests, intensifying public scrutiny.

After his death, most properties were liquidated to fund victim compensation.

Early Life and Bear Stearns Rise (1953-1981)

Brooklyn-born Epstein left New York University without a degree, taught at Dalton from 1974–76, and impressed Dalton-parent Alan "Ace" Greenberg, who recruited him to Bear Stearns and introduced him to his daughter.13

By 1978 he was executing option trades and designing tax-efficient swaps for top clients, SEC records show he became a limited partner in August 1980, entitling him to a one-time multimillion-dollar payout and a share of annual bonuses.1415

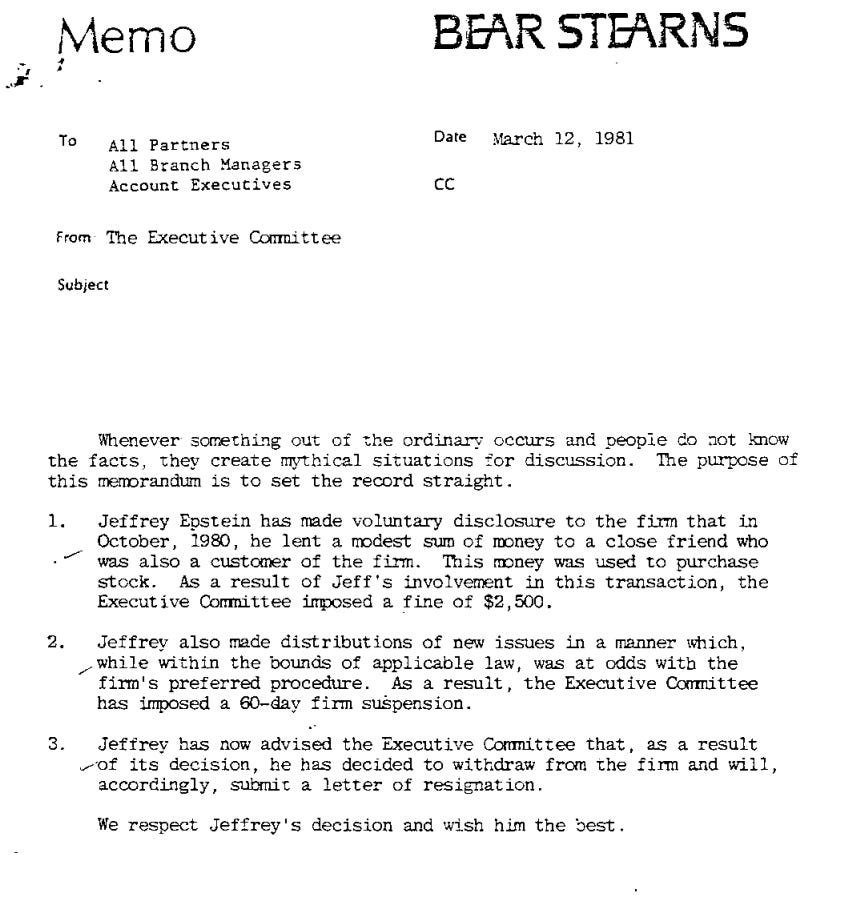

Bear Sterns Internal Memo

Bear Sterns Internal Memo

He resigned under internal review in March 1981.

Asset-Recovery and Towers Financial Period (1981-1991)

Epstein launched Intercontinental Assets Group (IAG) weeks after leaving Bear Stearns, pitching governments and tycoons on tracing looted capital. Saudi arms broker Adnan Khashoggi was an early client, per court filings in the Iran-Contra civil suits.16

In 1987 British arms adviser Douglas Leese introduced him to Steven Hoffenberg, who hired Epstein at $25k per month (equivalent to roughly $70,000 today) plus a $2 million loan to design the money-movement architecture for Towers Financial Corporation. By 1987, Epstein was operating out of the Villard Houses, a complex of 19th-century mansions on Madison Avenue that had been converted into luxury apartments and offices — a venue befitting the era's highest rollers.13

Epstein and Hoffenberg soon refashioned themselves as corporate-takeover specialists, trying unsuccessfully to buy iconic companies like Pan American World Airways. To finance this attempted buyout blitz, Hoffenberg was constructing what turned out to be an elaborate Ponzi scheme. Federal prosecutors later called Towers a $460 million fraud; Hoffenberg, facing a 20-year sentence, testified that Epstein was its "technical wizard," although Epstein was never charged.1718 Hoffenberg would later claim that Epstein stole over $100 million from Towers, although no other evidence corroborating this claim exists.

In 1988, Epstein recruited Julian Leese — Douglas Leese's son — for an internship at Towers. Julian's assignment was to help Towers raise money by selling what turned out to be fraudulent bonds to international investors. Julian introduced Hoffenberg to his father, who in turn introduced Hoffenberg to potential buyers. Among the customers to whom Julian sold Towers securities were his godparents. "It was a disaster," Julian later recalled.13

The Pennwalt Scheme (1988)

Separately in 1988, Epstein began soliciting millions of dollars from acquaintances, including Dick Snyder, the chief executive of Simon & Schuster, for what he suggested were win-win investment opportunities. Epstein and a few other investors began buying shares of Pennwalt, a $1 billion chemical company. After publicly disclosing their stake, they announced they were preparing a bid to buy all of Pennwalt for $100 a share — about 40 percent above where it was trading.13

Epstein and his partners didn't appear to have any intention of actually buying the company. But Pennwalt's stock shot higher in anticipation of a bidding war. Presto: They could sell the shares and secure a significant profit. The journalist Edward Jay Epstein (no relation) befriended Epstein and documented what was essentially legal market manipulation in a 1989 column in Manhattan, inc. magazine, describing Epstein only as "a 36-year-old friend who prefers to remain nameless."13

But Epstein's perfidy ran deeper. Dozens of the people Epstein recruited to invest in Pennwalt, including Snyder, later wrote to him demanding repayment. Epstein had lured investors in, used their money to book big profits, and then refused to return their funds. There is no record of Epstein facing any consequences. By the end of 1988, he reported being worth about $15 million, according to a previously undisclosed document from a Swiss bank that professor Thomas Volscho later uncovered.13

The Wexner Era and Power of Attorney (1991-2000)

A fateful flight to Florida in 1987 would launch Epstein from a mere millionaire into a plutocrat with palatial estates, two private islands, and luxury aircraft. The transformation came through a new client: Leslie H. Wexner, the billionaire who built brands like the Limited and Victoria's Secret. The two were introduced by Wexner's friend Robert Meister, an insurance executive who happened to sit next to Epstein on a plane to Palm Beach. Meister suggested that Wexner get in touch with Epstein for financial advice.13

Wexner soon had a financial adviser, Harold Levin, fly to New York to meet Epstein. Levin spent an hour with Epstein in his office and immediately got a bad vibe. He found a pay phone and called Wexner: "I smell a rat. I don't trust him." Wexner apparently didn't listen. About a year later, he hired Epstein to be Levin's boss. As far as Levin could tell, Epstein won the billionaire's confidence by falsely telling him that Levin had been stealing. Levin decided to quit rather than work for Epstein.13

Before long, Wexner had given Epstein essentially free rein by granting him power of attorney over his finances. By July 1991, Epstein held a notarized power of attorney granting the right to "execute, endorse, and deliver any and all documents" on Wexner's behalf. Epstein's name began appearing in government filings as responsible for Wexner's businesses and charities; some of Epstein's phones had Wexner's number on speed dial.1913

Almost immediately, Wexner's colleagues grew alarmed by his embrace of Epstein. "I tried to find out how did he get from a high school math teacher to a private investment adviser," the vice chairman of the Limited told The New York Times in 2019. "There was just nothing there." A Limited board member eventually became so troubled by Epstein that he hired Kroll, the private investigations firm, to see what could be unearthed about his past. Even Meister realized he'd misjudged Epstein and urged Wexner to cut ties. Once again, Wexner didn't listen.13

Epstein appeared to deploy a consistent playbook with wealthy men — including the private-equity billionaire Leon Black — instilling fear that their finances were a mess, that their advisers and even family members were inept or exploiting them, and that only one man had the wherewithal to save them. He seemed to be taking whatever he thought he deserved from Wexner's accounts, according to people who later learned what Epstein was doing. The amounts were often measured in the tens of millions.13

Epstein's lifestyle transformed accordingly. He ditched his one-bedroom in the Solow Tower and began leasing a grand marble townhouse on the Upper East Side — the former residence of Iran's deputy general consul — for $15,000 a month. He bought a mansion on 30 acres in New Albany, Ohio, where Wexner was building an enormous real estate development. He cruised around Manhattan in a Rolls-Royce Silver Spirit and began donating thousands to politicians, developing relationships that would serve him for decades. A pattern of exploitation emerged: the Solow building owner sued Epstein for not paying rent, the U.S. government sued him for illegally subletting the townhouse, and the Villard Houses owner made similar accusations.13

He re-branded his firm J. Epstein & Co. and managed more than $2 billion — largely Wexner family holdings in The Limited, Victoria's Secret, real estate, and municipal bonds. Epstein also posed as a Victoria's Secret talent scout, prompting more executives to complain to Wexner about his conduct, to no avail. He began citing his work for Wexner to prove his bona fides to banks, regulators, and journalists. For most of his life, Wexner would be his only publicly known client.13

During this span Epstein acquired the Manhattan townhouse at 9 E. 71st St. and an Ohio estate, both titled through Wexner-controlled trusts then transferred debt-free to Epstein entities.20

Later disclosures describe that by the mid-1990s Epstein was also managing money for a small number of other ultra-wealthy clients, including Elizabeth Johnson.

Tax-Haven Migration and Secrecy Structure (1996-2008)

In December 1996 Epstein redomiciled to St. Thomas, forming Financial Trust Co. (FTC) under the USVI Economic Development Commission, trimming federal income tax by roughly ninety percent in exchange for token local hiring.21

He layered the network with Liquid Funding Ltd. (Bermuda, 2000), a repo conduit 40 percent owned by Bear Stearns, Southern Trust Co. (USVI, 2011) to claim big-data research credits, and at least fifteen Delaware LLCs handling aircraft, islands, and art. FTC's 2013 regulatory filing listed $390 million in assets even after his 2008 Florida solicitation plea severed ties with Wexner.2223

Philanthropic Foundations and Investment Entities

Epstein created and used multiple foundations to support scientific research, education, and the arts, especially after his 2008 conviction, as a means to re-enter elite circles:

Events and Conferences Financed by Epstein

Epstein courted scientists and intellectuals by funding conferences and donating to research programs:

Principal Wealth Vehicles by Decade

Estimated Net Worth by Decade

Detailed Wealth Sources by Decade

1970s

1980s

By end of 1988, a Swiss bank document shows Epstein reported being worth approximately $15 million.13

1990s

2000s

Notable Interactions, Events, and Travel Logs

Epstein's social calendar included parties, philanthropic trips, and private dinners attended by world leaders and celebrities. Presence in these logs does not imply criminal activity.

Intelligence Gaps

- No audited statements for J. Epstein & Co. (1988–2007) or FTC (1997–2019).

- Full client roster beyond Wexner, Khashoggi, and an identified Rockefeller family trust remains unconfirmed.

- Liquid Funding counterparty list after Bear Stearns' 2008 collapse is under seal in SDNY bankruptcy exhibits.

Estate Valuation Snapshot (2019)

Probate filing: St. Thomas Superior Court, docket ST-2019-PB-272.1

Conspiracy and Unknowns

Major gaps exist in our understanding of Epstein's five-decade history, despite extensive documentation. Key unresolved questions span his entire career, from alleged early CIA ties in the 1970s to his documented 1980s social connections with British financier Sir James Goldsmith.13

Intelligence connections remained a central mystery through the 1980s and 1990s, with unverified reports that Epstein worked as a spy (or source, partner, or contractor) for the CIA or Israel's Mossad. In the 2000s, allegations surfaced about a sophisticated blackmail operation targeting prominent figures, though no concrete evidence emerged. Evidence of Gates blackmail appears amateur for a mastermind.

Critical details about his operations in the 2010s also remain hidden, including the full scope of his Southern Trust finances and missing portions of private jet flight logs that could reveal more about his alleged trafficking network and associates.

Significant evidentiary gaps remain from the 2019 investigation itself. The FBI raided only the Manhattan townhouse and Little St. James island a month after this death; properties in Palm Beach, New Mexico, and Paris were never subjected to federal search warrants, leaving potential evidence untouched. The full contents of the Manhattan safe — beyond the disclosed cash, diamonds, and hard drives — have never been publicly inventoried. Epstein's iPhone text messages and communications remain sealed or unrecovered. His IRS filings, which would reveal the true scope of income and deductions across decades, have never been released. Perhaps most critically, the complete network of trusts, shell companies, and offshore entities is known only to his longtime lawyer Darren Indyke and accountant Richard Kahn — the same individuals who now administer the 1953 Trust and control what remains of the estate.

Most unresolved questions stem from unreliable sources including personal memoirs, unverified claims, or sealed evidence. While legal proceedings exposed much of his operations, there are gaps in evidence, source of connections or wealth, operational methods, and potential government connections.

Evidence suggests Epstein leveraged his networking abilities and tax expertise to manage finances for ultra-high-net-worth clients while obscuring the movement of funds through complex financial structures.

Conspiracy theories stem primarily from the vast scope of Epstein's activities, his early connections to known arms dealers, limited personal research, significant gaps in public knowledge and documentation, and social media influencers who gained audiences by fueling speculative narratives about his connections and operations.

References

Footnotes

-

In re: Estate of Jeffrey E. Epstein, St. Thomas Superior Court probate inventory (Aug 2019). ↩ ↩2

-

Scams, Schemes, Ruthless Cons, New York Times ↩ ↩2 ↩3 ↩4 ↩5 ↩6 ↩7 ↩8 ↩9 ↩10 ↩11 ↩12 ↩13 ↩14 ↩15 ↩16 ↩17 ↩18 ↩19 ↩20 ↩21 ↩22

-

Wall Street Journal archival SEC partnership filings for Bear Stearns, Aug 22 1980. ↩

-

New York Times, "Wall Street Dealer Quits in Inquiry," Mar 13 1981. ↩

-

U.S. District Court, S.D.N.Y., Khashoggi v. United States deposition exhibits (1989). ↩

-

U.S. Securities and Exchange Commission v. Towers Financial Corp., 94-CIV-0811 (S.D.N.Y.). ↩ ↩2

-

Power of Attorney Giving Epstein Control of Wexner's Money, Business Insider ↩ ↩2

-

Columbus Dispatch, deed transfer records, Franklin County Recorder, Book 2829 pp. 114-127 (Dec 1998). ↩

-

Virgin Islands Economic Development Commission, certificate EDC-9607 (Dec 18 1996). ↩ ↩2

-

Bermuda Registrar of Companies, Liquid Funding Ltd. prospectus (Sept 2000). ↩

-

U.S. District Court, U.S.V.I., FTC financial statement attached to Jane Doe v. Epstein, 13-CV-00015. ↩

-

Primary Source Docs: Bear Stearns employment, 1970s. ↩ ↩2 ↩3 ↩4

-

Towers Financial consulting and asset-recovery correspondence. ↩ ↩2 ↩3

-

Primary Source Docs: Southern Trust and 2017 filings. ↩ ↩2 ↩3